views

Project finance is a funding model adopted by project owners to fund capital-intensive projects in public infrastructure, energy, and construction sectors. Unlike traditional financing, project financing is structured around the assets and cash flow of the project without sponsor guarantees.

The past two decades have seen an unprecedented economic boom, especially in emerging economies like China and India. Not to mention, project finance has paved a new wave of global interest and investments in projects that caused this economic boom.

Furthermore, regulatory reforms, improvements in corporate governance, and shifts in government policies for increased private investment have contributed to making the project finance model a preferred choice for long-term mega projects.

This article explains:

- What is project finance?

- How does project financing work?

- How has project finance become a popular model for financing long-term risky projects?

- How does project finance compare to other financing models like corporate finance and debt financing?

What is project finance?

In simple terms, the money borrowed to finance a project can be called project finance. Just like home finance is borrowed to purchase or construct a home, car finance is borrowed to purchase a car, similarly, project finance is the money borrowed from lenders to finance a specific project.

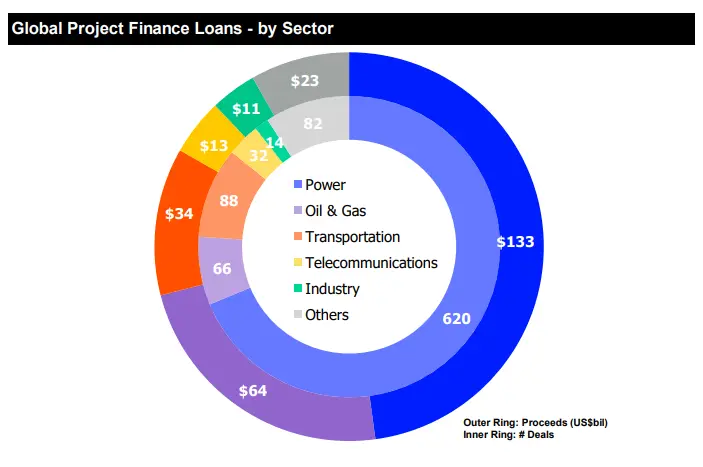

The projects that raise funding through project finance are highly capital-intensive, and the project development can take years. Large projects such as public infrastructure projects such as Highways, Railways, Ports, and Airports come under this category. Even private projects like oil and gas exploration and extraction, power generation and transmission, and telecommunication come under the category of mega projects that raise capital through project finance.

Project finance is different from traditional finance because the credit risk associated with the borrower is non-recourse. Unlike the traditional borrowing method, where the borrower bears the entire risk of repayment, in project finance, the borrower’s liability to repay is limited. This is because the debt funding is non-recourse or limited recourse in nature. That being said, the lenders can not claim the personal assets of the project owner in case the latter defaults on repayment or the project fails.

Global project finance statistics and what it says

Source: Refinitiv

Source: Refinitiv

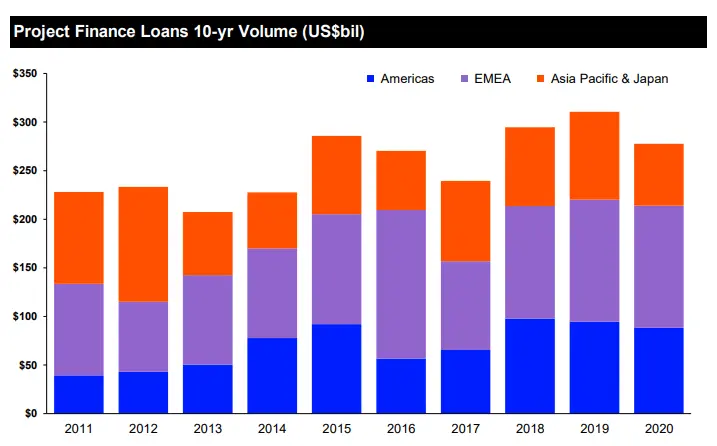

The above statistics show that the number of deals and value project finance is increasing each passing year. In the fiscal year 2021 alone, the project finance value has touched USD 97.3 B in the United States and the South and North America region, USD 148.8 B in the EMEA region, and USD 63 B in the Asia Pacific & Japan region.

There can be several reasons attributed to this YoY rise.

- Reliance on market mechanisms: A market mechanism, also known as a price mechanism, is a dynamic free market system where the price and quantity of commodities are decided by supply and demand.

- Regulatory reforms to attract private investment: Countries worldwide are now keener to reform their existing regulations and coming up with incentivization programs such as tax credits and special economic zones to attract private investors.

- Large-scale privatization: As per large-scale privatization programs, governments worldwide allow private companies to take over public assets or participate as equity investors to raise capital.

- Public Private Partnership: The Public Private Partnership Model or PPP model has been the most widely used vehicle for infrastructure investment. The private companies raise capital, build the facilities and recover its cost through revenue while the government grants concessions for the infrastructure project development.

Which types of projects are suitable for project finance?

Projects such as power plants, renewable energy projects, toll roads, exploration of natural resources, and airports are some of the sectors where the project cash flow starts only when the project is complete. That is why project finance reconciles the sharing of project risk among the project participants.